The Big Picture

The latest policy directive released by the Federal Open Market Committee (FOMC) didn't contain any surprises.

The FOMC voted unanimously to leave the target range for the fed funds rate unchanged at 0.00-0.25% and the Federal Reserve's asset purchase program unchanged. That program involves the purchase of at least $80 billion per month of Treasury securities and at least $40 billion per month of agency mortgage-backed securities.

The directive acknowledged that "indicators of economic activity and employment have strengthened" thanks to progress on vaccinations and "strong policy support," but the directive also acknowledged that "risks to the economic outlook remain."

What He Said

The latter is stating the obvious. There are always risks to the outlook. Nevertheless, this cautious-minded perspective was another way of saying that monetary policy isn't going to be changed soon.

At his press conference, Fed Chair Powell pretty much said the same without directly saying it.

- He said the time has not arrived to start talking about tapering asset purchases, that the Fed will let the public know when the time has arrived to have that conversation, and that the decision to taper will be communicated well in advance of the actual taper.

- He said the economic recovery remains uneven and far from complete.

- He said inflation pressures are expected to be transitory and downplayed the risk of inflation pressures building like they did in the 1960s and 19070s.

- He said it will take some time before we see "substantial further progress" in economic activity and that the Fed will act on actual data, not on forecasts.

- He said that he thinks it's appropriate and important for financial conditions to remain accommodative to support economic activity.

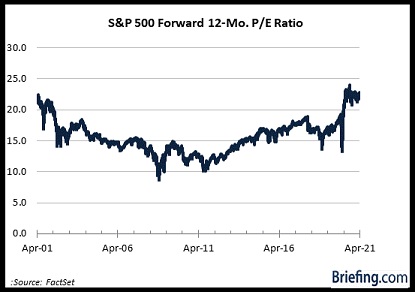

One surprise is that Mr. Powell acknowledged that the Federal Reserve is seeing things in the capital markets that are "a bit frothy."

He volunteered that monetary policy could be part of that but was quick to add that the big move in the stock market the last few months had more to do with the vaccination efforts and reopening activity.

Overall, he thinks the financial stability picture is mixed, but manageable on balance given that leverage in the financial system is not a problem and that the household sector is in pretty good shape.

No Mistakes

There was no mistaking from the press conference, though, that the Fed is not going to be swayed by scary-looking inflation numbers in the short term.

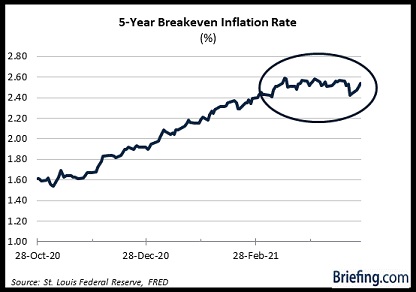

Fed Chair Powell continued to stress that base effects will be in play there, meaning the inflation spikes will be a function of math above all else. He did point to supply chain bottlenecks being a part of the equation, but even there, he was not convinced those bottlenecks will be long-term issues.

It was a plausible argument. The question is, will the market keep buying that argument? The answer has a lot of important implications for the capital markets.

What It All Means

If the market's patience runs thinner than the Fed's patience, it will be reflected in long-term rates moving up at a quicker pace and stock prices becoming more volatile with a downward bias.

Things are still stable, which is probably something the Fed is pleased to see. In a certain respect, they should be stable since there weren't any real surprises in the latest policy update.

With inflation expectations remaining elevated, though, even as Fed Chair Powell drives home his "transitory" view, it is fair to say that the market isn't convinced that the Fed chair's view is infallible.